How does vesting work?

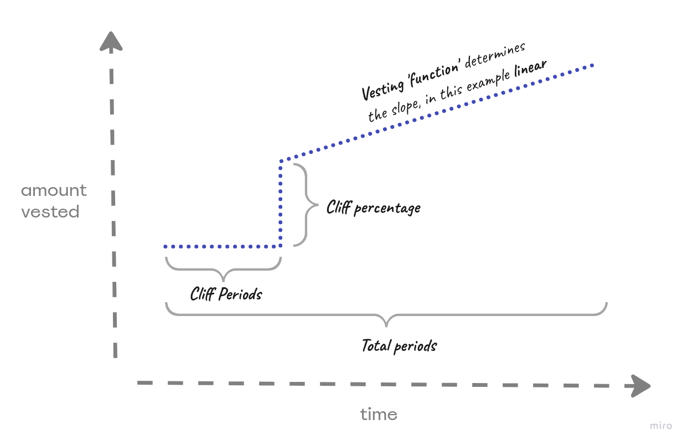

Vesting is a regulation that allows you to limit rights such as tradability. With a time-bound vesting schedule you agree how over time an asset will become truly unconditional owned by the recipient.

On Share Council you can turn vesting on or off and select a vesting schedule when making a trade. Turn on your vesting and this has consequences:

- A holder of non-vested pieces cannot sell or send their non-vested pieces

- An administrator can stop the vesting of a participant, causing all non-vested pieces to be offered back to the Distributor

An article about Vesting will also be included in the to the transaction attached Deed of Transfer.

Example article Deed of Transfer: 4 years total with 1 year cliff

Article 5: Vesting

- These Depositary Receipts will have a vesting period of 36 months in aggregate, commencing on January 1, 2023 and ending on January 1, 2026. During this period, the Depositary Receipts will become vested and final according to the schedule specified in this article.

- On January 1, 2024, which is 12 months after the Vesting Start Date, 34% of the Depositary Receipts will vest.

- From January 1, 2024, equal amounts of 2.75% of the Depositary Receipts will vest each month until all Depositary Receipts are vested. All Depositary Receipts are vested on January 1, 2026.

- At any relevant time when the total number of vested Depositary Receipts is calculated, this number will be rounded down to the next whole number.

The vesting of the Depositary Receipts shall terminate immediately and automatically on the day Buyer leaves employment, regardless of the reasons for termination of employment or the manner in which employment is terminated.