Stock Appreciation Rights (SARs): everything you need to know!

Stock Appreciation Rights (SARs) offer employees a straightforward way to participate in the financial success of the company they work for. Because SARs operate through private contracts, they are flexible and easy to set up. However, there may be disadvantages, particularly in terms of taxation and the number of years of service. Nevertheless, SARs offer enough advantages for the employer to consider. You can read all about it in this article.

What are Stock Appreciation Rights (SARs)?

A SARs scheme is the easiest way to implement employee participation in your company. It is a contractual obligation you enter into with your employees: if the value of the company reaches a certain level within a specified period, the employee will receive a certain amount of money and/or (certificates of) shares if they are still employed. This does not actually make the employee a co-owner; it resembles more of a bonus system (hence SARs are also called virtual shares or phantom shares). However, it allows the employee to share in the success of the company.

How do Stock Appreciation Rights (SARs) work?

Stock Appreciation Rights (SARs) are essentially just a (contractual) agreement between the employee and the company: an employee and the company agree that the employee will receive X amount if the company is worth Y on Z date. The more the company is worth on date Z, the more money X the employee receives. Because it is nothing more than an agreement about a monetary claim, the scheme works in any country in Europe.

What are the benefits of SARs?

Private agreement: The SARs scheme involves a private contract between the employee and the employer. All agreements can be recorded in a private agreement. This means you don't need to go through a notary, making a SARs scheme very flexible.

No money transfer from the employee to the company: The SARs scheme gives the employee a claim on the employer if the company achieves a certain value. Unlike buying (certificates of) shares, no money needs to be transferred to the company.

Looser connection between the company and the employee: The employee does not become a co-owner of the company. This keeps the relationship between the two very loose.

No corporate rights or obligations: SARs have no rights and obligations attached to them, unlike shares. For example the voting rights or the right to dividends, which the entrepreneur retains control over with SARs.

Good tool to offer an extra: The SARs scheme is straightforward, and the employee does not become an actual co-owner. Therefore, an SARs scheme is a good tool to offer the employee an extra alongside good employment conditions.

What are the disadvantages of SARs?

Tax is entirely the responsibility of the employee

Take, for example, a bonus of €50,000 if the company is worth at least €1 million within 5 years. This would be a considerable amount if:

- It is fully paid out;

- The employee is the actual owner; and

- An employee can always reap the benefits.

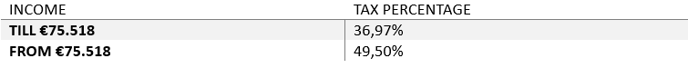

But, as you might have guessed, this does not apply in practice. Because the employee has never made an investment, it is not taxed as wealth - box 3. It is considered a cash bonus, which is taxed as income in box 1 or box 3. Income tax is a progressive rate, meaning that if you receive more income, you also pay more tax. In 2024, the following percentages apply in The Netherlands:

If we take the example with a bonus of €50,000. Imagine that the annual salary is also €50,000. The total income will then be €100,000. Tax is levied at 36.97% on the first €75,518. Tax is levied at 49.50% on the remaining €24,482. This leaves €59,963 after deducting taxes. If the bonus had not been paid, the employee would have received €31,515 after deducting taxes. In this situation, only a maximum of €28,448 bonus remains for the employee after deducting taxes from the €50,000 bonus.

However, the payout is tax-deductible for the employer, without further consequences for a possible fiscal unity. Therefore, SARs schemes are generally more fiscally favourable than (for example) an employee stock option plan (ESOP) for the employer.

No full co-ownership

The employee is entitled to a cash bonus at a later date. Therefore, at the moment the SARs is implemented, they own nothing.

Employee cannot exit a SARs scheme prematurely

The SARs scheme is intended to bind an employee to the company. That's why the scheme often requires that the employee remains employed with the company for the entire agreed-upon period. If the employee leaves the company prematurely, they will end up with nothing. It is also generally not possible to transfer a SAR.

What to consider when establishing a SARs scheme?

As mentioned earlier, you are completely free to determine the conditions for the SARs scheme. There is no legal framework established. However, you should think about when the employee can claim the reward: is it when they leave the company, during an acquisition, or after a certain period. Additionally, you can consider agreements on how you value the company, a buyout amount if the employee leaves earlier (early leaver) or is dismissed (bad leaver), and the non-transferability of the SAR.

More questions?

If your curiosity is piqued and you want to know more, we are ready to answer all your questions. For example, join our webinar, where you can ask us all your questions!