Trust Office Foundation / Stichting Administratiekantoor (STAK)?

Many entrepreneurs want to issue shares in their company but do not want the shareholder to take control of their company. There is a solution for this: the Trust Office Foundation (STAK). In this article, you will learn everything you need to know about it from A to Z!

What is a STAK?

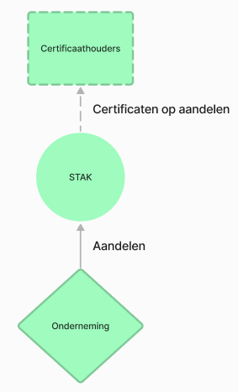

A STAK is a foundation created to separate the voting rights from the economic rights. The STAK takes over the shares of a company and then issues them again in the form of share certificates. These certificates only represent the economic ownership of the shares and not the voting rights. In this way control over the company remains with the STAK.

How does a STAK work?

To start, the STAK takes over the shares of the company. In exchange, the STAK issues share certificates. The STAK will handle the share administration. Since the share certificates do not carry voting rights, these rights remain with the STAK. The board of the STAK can continue to exercise the voting rights in the general meeting of shareholders of the company. However, the certificate holders will obtain the economic rights, such as dividend payments. Additionally, the articles of the STAK can include provisions that give the certificate holders a say, for example, the right to dismiss or nominate directors of the STAK.

What are common purposes of a STAK?

Some common purposes include:

- Ease of transfer: Share certificates can be transferred without the involvement of a notary.

- Employee participation: Companies can allow employees to participate in profits through a STAK without granting them direct control.

- Protective structure: It can serve as a protective structure to prevent unwanted takeovers or influences by separating voting rights from the general interest.

- Succession planning: A STAK can be used for estate planning and succession within family businesses without losing control over the company.

What are the legal considerations for a STAK?

A STAK must be established through a notarial deed and registered in the trade register. You will need to visit a notary to establish the foundation. The rights and obligations of the certificate holders and the board of the STAK must be clearly defined in the articles and administrative conditions of the foundation.

Do you need to prepare financial statements for a STAK?

The same rules apply to a STAK as to any other foundation. Since the STAK has no intention of making profits and only manages the share administration, you are not required to prepare financial statements. However, it is allowed to voluntarily prepare financial statements. This could be the case if this useful and clear for the parties involved.

More questions?

If your curiosity is piqued and you want to know more, we are ready to answer all your questions. For example, join our webinar, where you can ask us all your questions!